Cost / License

- Paid

- Proprietary

Platforms

- Software as a Service (SaaS)

Artemis KYC is described as 'Artemis is a multiple award-winning KYC, AML, and CTF compliance platform developed by Cynopsis Solutions. It is designed to help financial institutions and regulated entities meet global, regional, and local regulatory requirements with speed, accuracy, and confidence' and is a identity management tool in the network & admin category. There are nine alternatives to Artemis KYC for a variety of platforms, including Web-based, SaaS, Windows, Android and iPhone apps. The best Artemis KYC alternative is FinAuth. Other great apps like Artemis KYC are Pixalytica, Jumio Netswipe, Vespia and Focal.

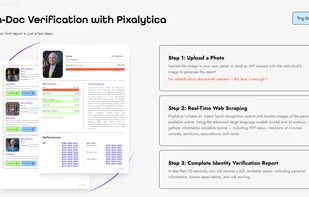

Pixalytica uses an AI-based facial recognition and automated public web-searching to generate KYC and identity verification reports in under 20 seconds.

Camera + Credit Card = Secure payment:

Jumio’s patent pending technology turns the camera of the computer into a credit card reader. The most secure form of online payment possible.

Step 1: Scan your card. (online card present transaction).

Step 2: Enter security (CVV) code to.

Vespia is an all-in-one AML solution for verifying and onboarding business customers and partners in under 30 seconds. The company helps AML-obligated businesses understand whom they are dealing with using the power of AI.

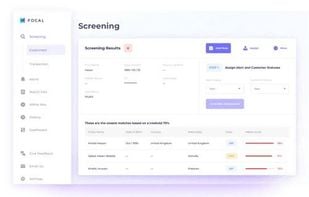

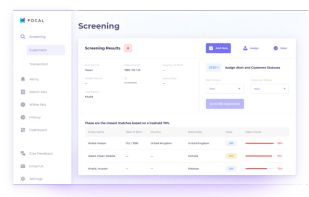

FOCAL by Mozn is a suite of products that leverage our powerful AI and machine learning technology to answer the challenges of AML compliance and Fraud Prevention in Emerging Markets.

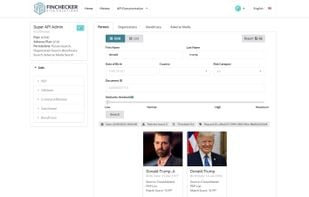

Finchecker offers an all-in-one technical toolkit to cover all your KYC and AML needs. We are constantly working with Compliance officers from around the world to build an efficient and simple to use Compliance solutions that are in line with the regulatory requirements.

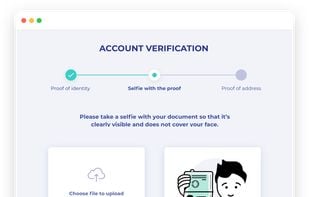

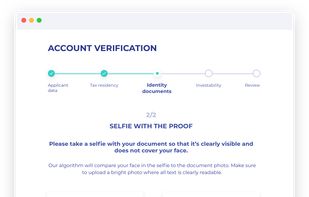

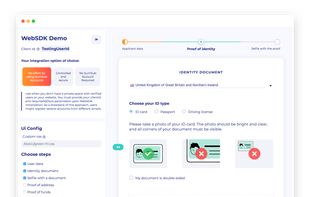

Sumsub is the one verification platform to secure the whole user journey. With Sumsub’s customizable KYC, KYB, transaction monitoring and fraud prevention solutions, you can orchestrate your verification process, welcome more customers worldwide, meet compliance requirements...

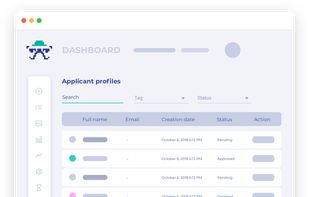

KYC Hub enables organizations to mitigate the risk of financial crime via workflow orchestration, data aggregation, and a risk engine enabling rapid building and deployment of risk detection and automation applications for different use cases.

Identomat provides AI-powered Identity Verification & KYC/AML compliance software as a service. Identomat's proprietary solution with Liveness Detection, Face Matching, Identity Document OCR, Address Verification, AML Monitoring, and Video KYC for AI-driven or Agent-led...