A smarter loan. You earned it. Upstart is an online lending platform that uses data to bring together high potential borrowers and investors.

Cost / License

- Free

- Proprietary

Platforms

- Online

CommonBond is described as 'Online lending company that makes education finance better. Through CommonBond, our members gain access to a robust suite of low fixed- and variable-rate student loan products to refinance existing student loans after graduation or to finance an MBA while in' and is an website in the business & commerce category. There are nine alternatives to CommonBond, not only websites but also apps for a variety of platforms, including iPhone, SaaS, Android Tablet and iPad apps. The best CommonBond alternative is Upstart, which is free. Other great sites and apps similar to CommonBond are Student Loan Hero, LendingClub, Affirm and FundMore.ai.

A smarter loan. You earned it. Upstart is an online lending platform that uses data to bring together high potential borrowers and investors.

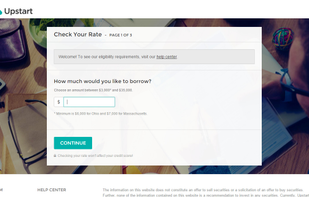

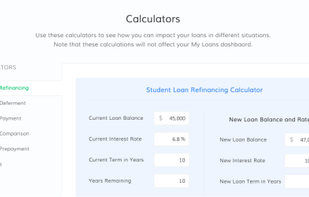

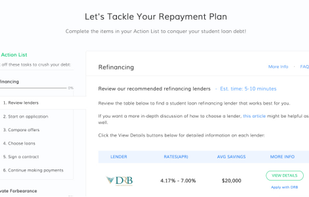

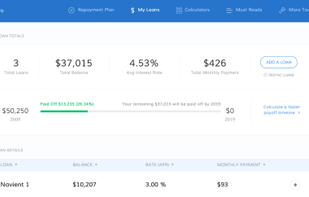

Student Loan Hero is an online tool that helps borrowers figure out the smartest way to manage and pay off student loans. Our app allows you to sync both federal and private student loan data into an easy-to-use dashboard.

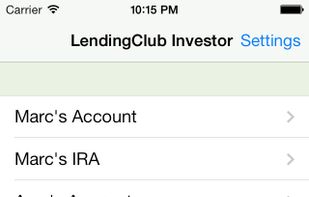

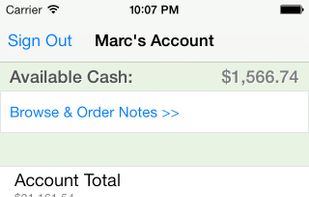

We’re transforming the banking system to make credit more affordable and investing more rewarding. We operate at a lower cost than traditional bank lending programs and pass the savings on to borrowers in the form of lower rates and to investors in the form of solid returns.

Affirm offers easy financing - without a catch. There are no gimmicks like deferred interest or hidden fees, so the total you see at checkout is always what you’ll actually pay.

FundMore-ai is an automated underwriting system that uses machine learning to streamline the pre-funding process for loans.

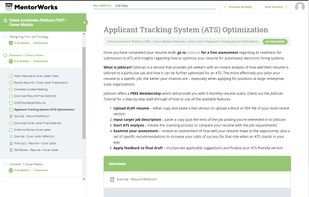

MentorWorks provides an alternative to loans via income share agreement (ISAs) to fund students' higher education and certificate programs as well as the career coaching via the Talent Accelerator Platform (TAP) to help students find full-time jobs.

With Vouch loans you are more than a credit score, because you create a network of people who sponsor you. Sponsor people you trust and invite people to sponsor you. When people sponsor each other they can help each other get better loans.

Earnest is a technology enabled lender that rewards financially responsible people with better rates than traditional lenders.