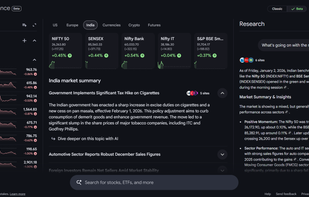

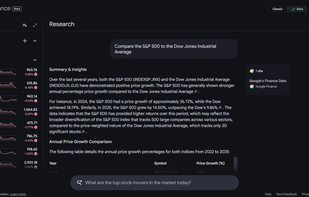

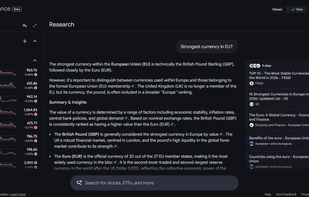

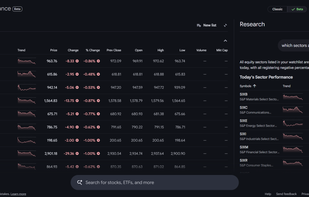

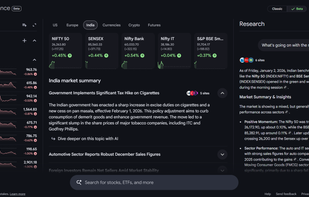

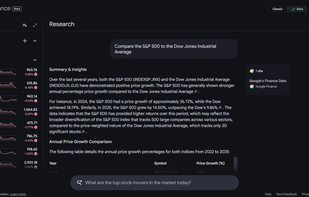

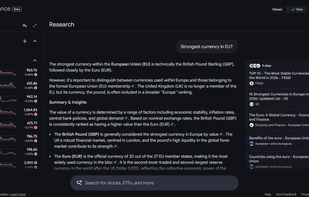

Google Finance offers a broad range of information about stocks, mutual funds, public and private companies. In addition, Google Finance offers interactive charts, news and fundamental data.

Company 360 is described as 'Value investors profit by investing in quality companies. Because their method relies on determining the worth of company’s stock, value investors don't pay attention to the external factors such as market volatility and daily price fluctuations' and is a Stock Trading app in the business & commerce category. There are more than 10 alternatives to Company 360 for a variety of platforms, including Web-based, iPhone, iPad, Android and SaaS apps. The best Company 360 alternative is Google Finance, which is free. Other great apps like Company 360 are Firstrade Securities, Seeking Alpha, Simply Wall St and The Motley Fool.

Google Finance offers a broad range of information about stocks, mutual funds, public and private companies. In addition, Google Finance offers interactive charts, news and fundamental data.

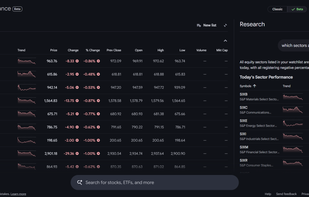

Commission-free trading platform offering stocks, options, ETFs, and mutual funds. Features include real-time data, financial research, multi-account management, fund transfers, options strategies, no-fee IRA, and two-year account history.

Simply Wall St is Pintrest/Xero for the stock market. We give everyday people the power to make their own investment decisions by meaningfully visualizing the stock market in a way that has never been done before.

Stock information and investing advice from The Motley Fool.

App features include:

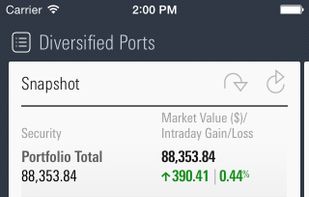

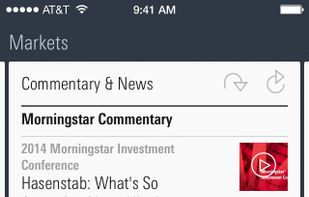

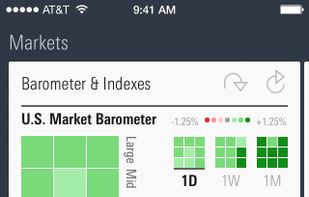

Since 1984, Morningstar has served investors with the resources they need to make sound financial decisions. Now you can experience the best from our flagship website with Morningstar for Investors app - monitor the markets, track your portfolio, research securities, and more.

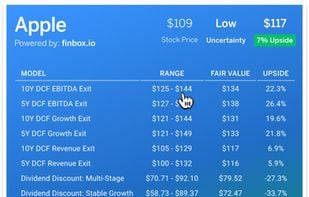

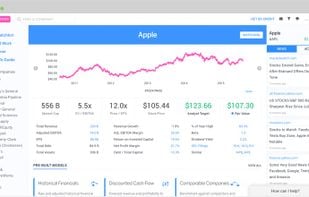

Finbox is an online equity research platform designed for value investors who are serious about fundamental analysis. Here's a quick overview of some of our tools.

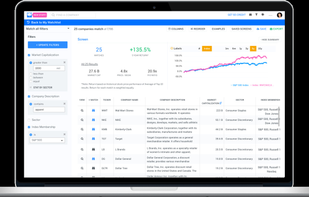

TipRanks is a comprehensive investing tool that allows private investors and day traders to see the measured performance of anyone who provides financial advice.

We help the DIY investor by reducing all the complexities of accounting, and all the information noise that today floods investors, to a series of normalized and easy-to-use <strong>scores</strong> covering the most important aspects of every company's financials.

Taurigo is an online platform that provides investors with AI-powered tools for comprehensive stock analysis, interactive screeners, portfolio tracking, and comparison features to support informed investment decisions.

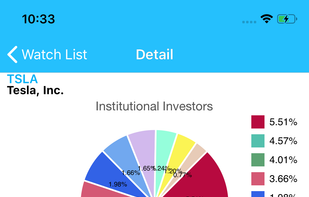

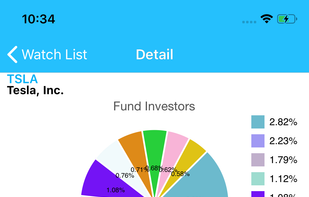

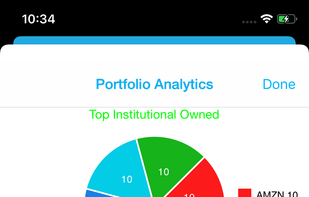

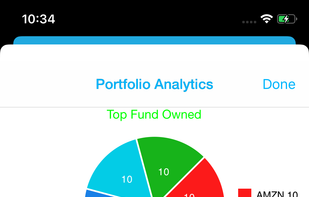

Would you like to know if your stock picks are also the choices made by Berkshire Hathaway (Warren Buffett ), Blackrock, FMR (Fidelity) and other institutional/fund super investors? Do their holdings match your portfolio?

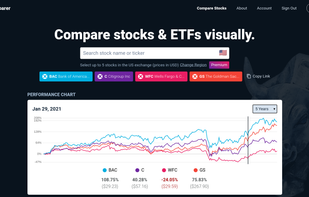

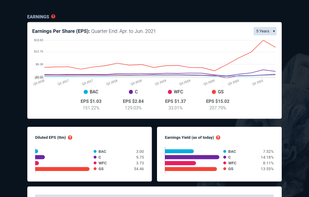

Stock Comparer makes it easier for users to analyze stock fundamental data by comparing multiple stocks together. It's beginner friendly with a simple user interface that includes tooltips that explain the significance of different financial data.