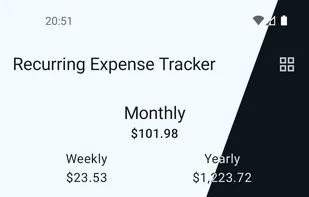

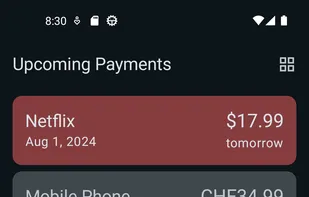

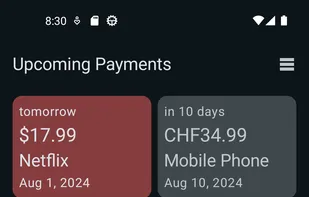

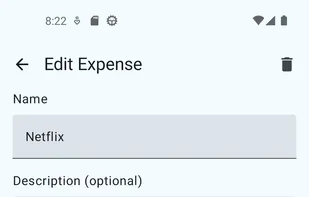

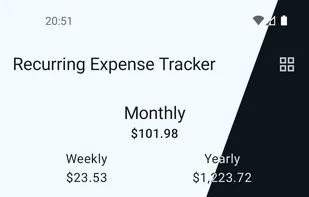

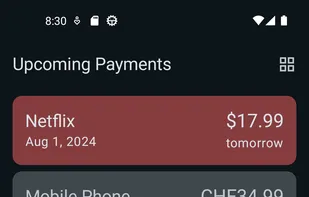

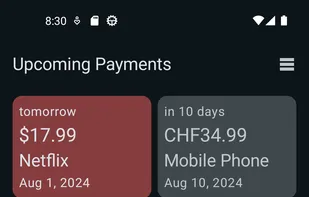

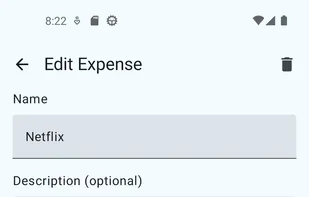

Recurring Expense Tracker is a Material You recurring expense tracker, allowing you to keep track of your monthly spending. As its name suggests, it focuses on reccurring expenses such as rent, insurances, subscriptions etc.

WellPaid is described as 'The only all-in-one subscription manager for households. Identify bills, track spend, split costs, and share passwords together' and is a subscription tracker in the business & commerce category. There are more than 10 alternatives to WellPaid for a variety of platforms, including iPhone, Web-based, Android, iPad and SaaS apps. The best WellPaid alternative is Recurring Expense Tracker, which is both free and Open Source. Other great apps like WellPaid are Subscription Day Calendar, Monarch, Rocket Money and Tilla.

Recurring Expense Tracker is a Material You recurring expense tracker, allowing you to keep track of your monthly spending. As its name suggests, it focuses on reccurring expenses such as rent, insurances, subscriptions etc.

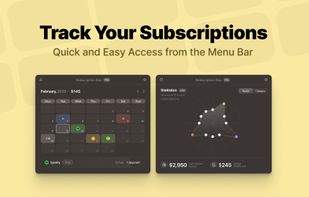

If you have so many subscriptions you can’t even count them—and you hate surprise charges when you forget to cancel—we built Subscription Day just for you. That’s why we made a simple, powerful subscription calendar for your Menu Bar. No clutter, just what matters:

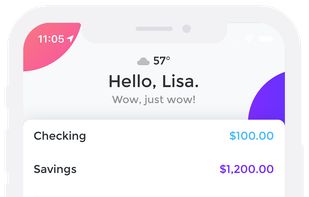

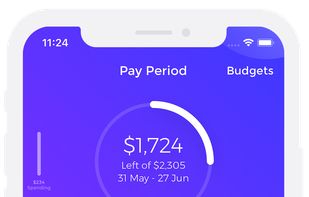

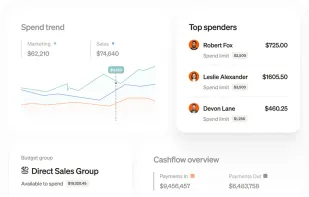

The modern way to manage your money. Monarch makes it easy to track all of your accounts, optimize your spending, analyze your investments, and create a financial plan to achieve your goals.

Managing money is hard, but you don’t have to do it alone. Rocket Money empowers you to save more, spend less, see everything, and take back control of your financial life.

Tilla is your new app to keep track of all your subscriptions without any limitations. Manage your notifications and get notified when a bill is due.

Keep track of your subscriptions. Get insights in your fixed costs. Manage your subscriptions and get notified when a bill is due.

Emma helps you avoid overdrafts, cancel wasteful subscriptions, pay off debt, save money and track your spending. She uses state of the art technology to analyse your personal finances and give you the power to make smarter decisions with your money.

Optimize financial wellbeing with subscription and bill tracking, auto-payment management, budget control, renewal alerts, and secure 256-bit SSL data protection.

PocketGuard is a free budgeting app for people who want to be on top of their money. Personal finance is made simple by smart algorithms, which means budgeting with PocketGuard is so easy that you don't have to spend your entire life crunching numbers.

Organize and Manage all Your Monthly Financing, Insurance, and Subscription Expenses from One Dashboard. Add Financing, Loans, Insurance, and Services to Grow your Business from your Account.

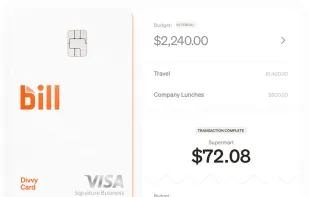

Bill.com is an AI-driven platform designed to streamline financial operations. This comprehensive solution offers a range of features, including bill creation and payment, invoice sending, expense management, budget control, and access to credit for business growth.

Not all the subscriptions on your credit card bill should be there. Trim helps you find your subscriptions and cancel the ones you don't want as well as providing spending alerts and keeping you updated on your account balance.