Revolut is described as 'International banking alternative offering multi-currency transfers, budgeting, and expense tracking, with crypto exchange options and fair currency rates' and is a Money Transfer service in the business & commerce category. There are more than 25 alternatives to Revolut for a variety of platforms, including Android, iPhone, Web-based, iPad and Android Tablet apps. The best Revolut alternative is Wise. It's not free, so if you're looking for a free alternative, you could try MiniPay Wallet or N26. Other great apps like Revolut are Skrill, Monzo, Curve and Monese.

With just a few taps, you can easily send money to your family and friends anywhere in the world. Our user-friendly interface and advanced security measures ensure a seamless and secure experience.

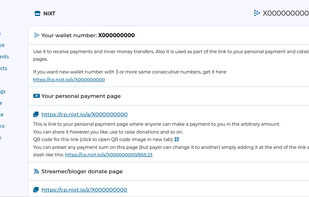

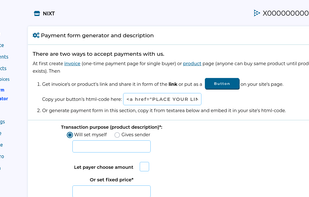

Anonymous payment system and donations collecting platform with friendly interface and simple to use implementation of accepting crypto-payments. Accept monero (XMR) on your site or app.

Unleashing the Energy of Money. We’re freely supercharging everyone with the tools, products and education to look and act like a financial rockstar - to learn how to manage financial life on your terms.

Suits Me caters to individuals who may face challenges obtaining a conventional UK bank account, such as foreign nationals, expatriates, freelancers, or those with poor credit or no banking background.

MomoPay offers a seamless platform for managing your finances. With its virtual debit card options, low fees, and secure KYC process, users can make payments, transfer funds, and shop globally.

A privacy-first crypto spending bridge allowing digital nomads to spend USDC and stable coins at physical stores via Apple Pay and Google Pay.

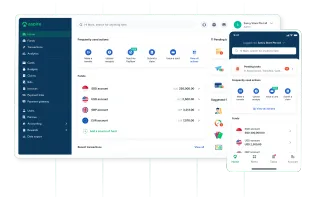

Send and receive payments in over 130 countries, manage multiple currencies, issue instant virtual and physical cards, use detailed spend controls, automate finance workflows, and access real-time expense tracking with live multilingual support and accounting integration.

Since our launch in 2024, GoDutch has grown from an idea into a fast-growing alternative for entrepreneurs who are fed up with slow processes, hidden costs, and banks that mainly reward themselves. We believed things had to change. Fast, fair, and smart.

It has lower costs, it has no-KYC, provides payment solutions for users that want privacy and have crypto.